ALONE IN THE CROWD: How Gen Z’s Loneliness Is Fueling a Boom in U.S. Live Shopping

Prefer reading this in a PDF Format?

Subscribe to our newsletter to instantly download the PDF.

EXECUTIVE SUMMARY

After years of overseas success, live shopping—which blends digital commerce, social engagement, and live entertainment—is booming in the U.S. One key to its growth is Gen Z, the world’s first “digital native” generation. Born between 1997 and 2012, Gen Z is notable for both its social-media savviness and pervasive loneliness, two qualities that intersect in the space of live shopping. More than any other generation, Gen Z goes to live-stream retail spaces (such as TikTok Live, Whatnot, and Amazon Live) for social interaction and connection in addition to commerce.

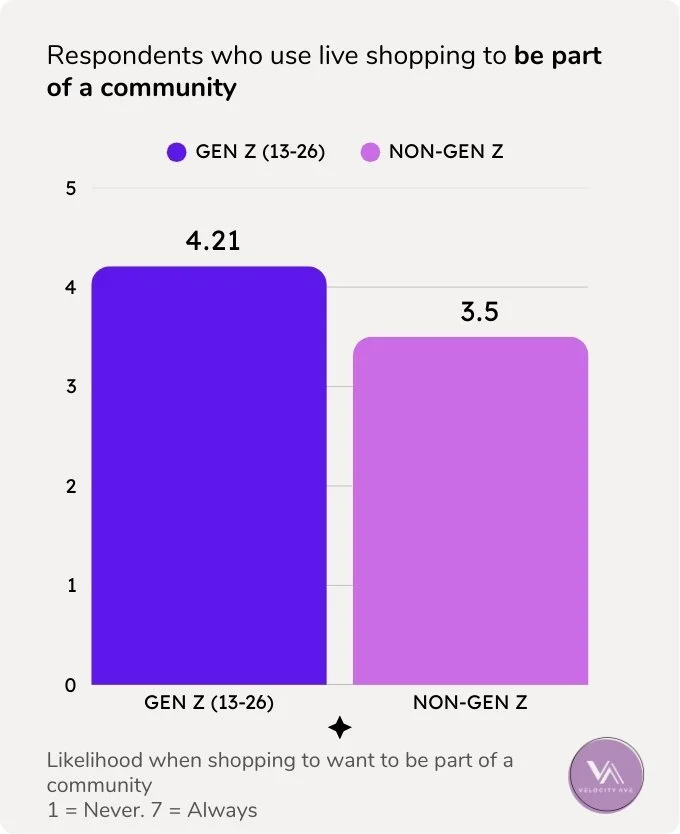

Velocity Ave’s research shows that, compared to older generations, Gen Z is 20% more likely to choose live shopping in order to “be part of a community.” At the same time, they’re 30% more likely to worry about how they’re perceived by other users. For Gen Z shoppers, the communal dimension of live shopping can be a double-edged sword, offering the joy of connection alongside the threat of judgement. To optimize these spaces for Gen Z, live shopping platforms should design for positive interaction and authentically connected communities—not just bargain-hunting crowds.

CONTEXT

Retail, Reinvented: The U.S. Live-Shopping Boom

Mix the immediacy of livestreaming with the simplicity of online shopping and the gavel-pounding excitement of an auction house, and you’ll have something close to the experience of live shopping. Also known as livestream shopping or live e-commerce, the format is a unique blend of e-commerce, social interaction, and live entertainment. Sellers offer everything from lip kits to auto parts, connecting with buyers in a real-time digital space built for consumption and social connection. It’s a potent mixture, with one study showing that live shopping can drive conversion rates up to 30%—about 10x higher than traditional e-commerce.

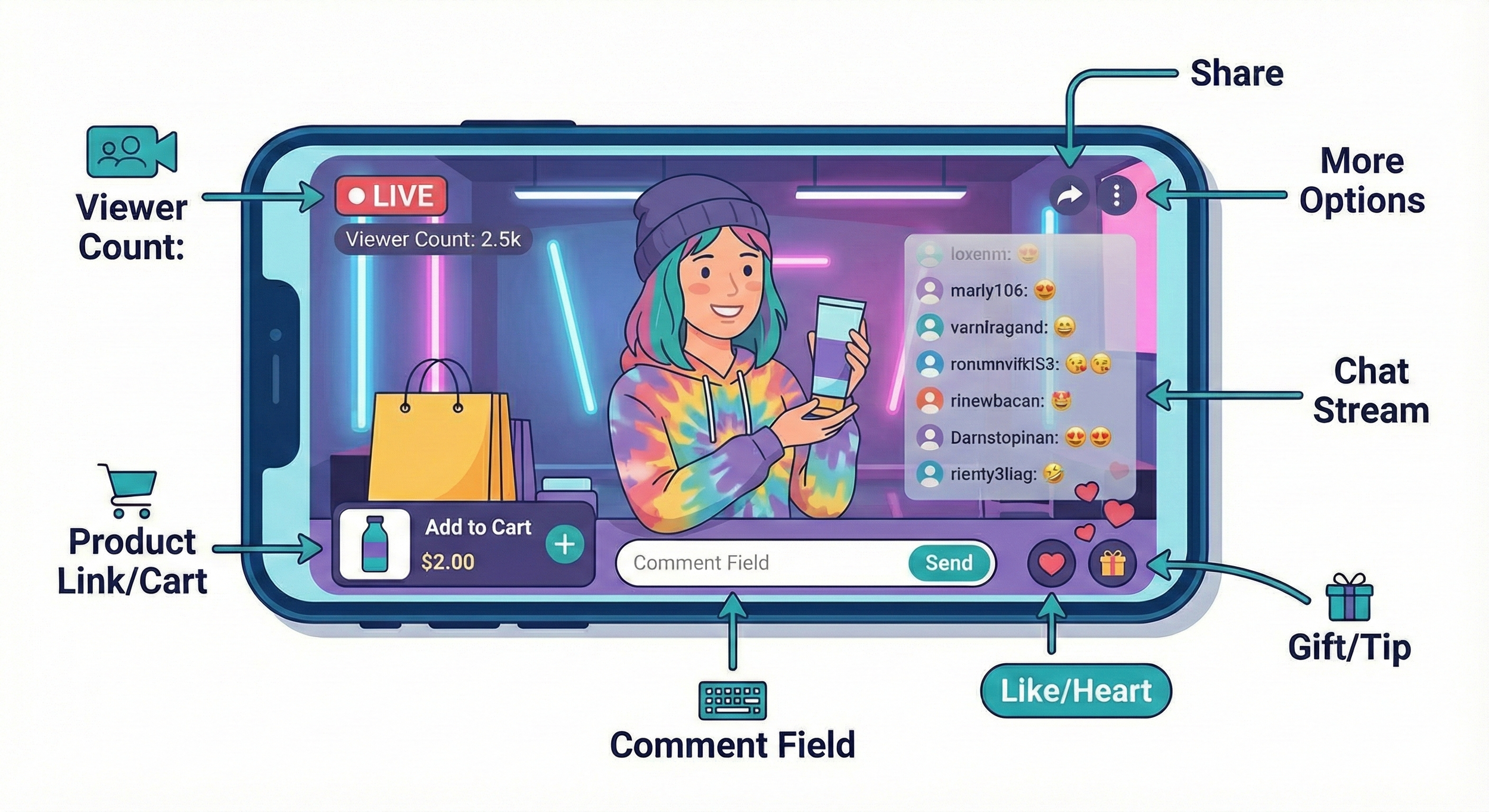

Live shopping elements

But the format hasn’t always had equal success around the globe.

Since launching in 2016 on Alibaba’s Taobao Live platform, live shopping has quickly become a dominant venue for online commerce in Asia. In China, 87% of consumers participate in live shopping every month, and their purchasing power is undeniable. During one 30-minute period in 2020, Taobao Live drew an astounding $7.5 billion in transactions, according to one report.

Meanwhile, in the U.S., live shopping struggled to break its association with decades-old linear TV networks such as QVC and HSN, which featured televised sales and call-in buyers. After briefly experimenting with the format, Facebook shuttered its live-shopping feature in October 2022, leaving the future of the space uncertain. Despite clear potential—in one study, nearly half of American consumers said they wanted to buy more via live formats—the live-shopping space remained largely unexplored in the world’s wealthiest country.

Until now. Live shopping is on the rise.

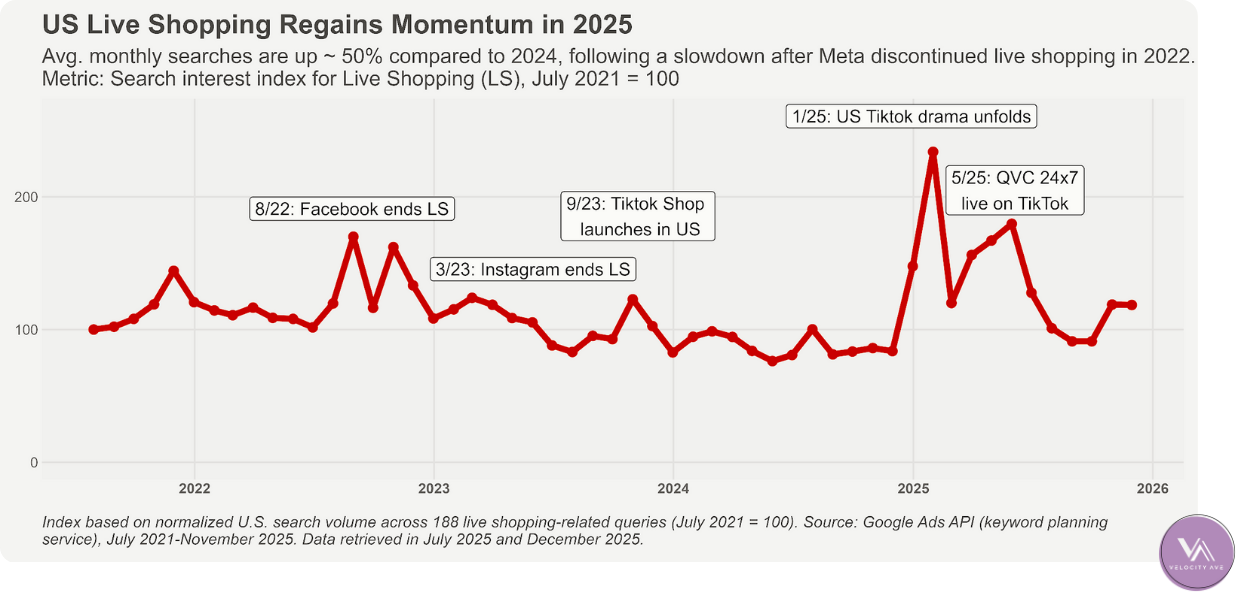

Thanks to the rapid growth of US-based platforms such as TikTok Live, Amazon Live, and Whatnot, the number of global live-shopping buyers has climbed to 49 billion this year, on a path towards 60.6 billion by 2028. Monthly searches for live shopping-related terms have spiked approximately 50% compared to 2024.

US Live Shopping Search Interest

TikTok, which unveiled its TikTok Shop in 2023, hosted over 8 million hours of live shopping sessions in the US in 2024. The U.S. livestream giant Twitch, home to more than 240 million monthly active users, launched its first live-shopping collaboration this year, partnering with the cosmetics brand e.l.f. to add a “shoppable in-stream element” to real-time video. Even live-shopping legacy brand QVC added over 100,000 customers from TikTok Live during Q2 of 2025 alone.

Investors are taking notice, too: Whatnot recently raised $225 million at an $11.5 billion valuation and projects $6 billion in sales in 2025—doubling its revenue from the previous year.

One key factor in the rise of live shopping: Gen Z.

Gen Z shoppers, born between 1997 and 2012, aren’t the only age group flocking to live shopping. But their connection to the format is both exceptionally strong and growing fast. In a recent poll, 15% of Gen Z respondents reported watching live shopping during the previous week—two to three times more than older generations. Gen Z is also the dominant age group on TikTok Live, the single largest live-shopping platform in the US. Approximately 44.7% of all TikTok users are Gen Z, and 52.5% of Gen Z shoppers use TikTok for shopping or product discovery every month. Younger Gen Z shoppers (born between 2007 and 2012) are 13% more active on TikTok Live than older generations.

What makes Gen Z unique in live shopping? A desire for connection…

Often called the first “digital native” generation, Gen Z has never known life without the internet, computers, and mobile phones. Their worldview has been forged by rapid technological innovation and ubiquitous digital connection—but also by the pressures of social media, the catastrophic effects of climate change, and the global upheaval of the COVID-19 pandemic, which struck when they were between 8 and 23 years old.

Perhaps unsurprisingly, Gen Z reports higher rates of mental health issues, including anxiety and depression, than any other generation. They’re also the loneliest. According to the Department of Health and Human Services, “People between the ages of 15-24 spend 70% less time in person with friends than those of the same age did in 2003. This difference amounts to nearly 1,000 fewer hours per year.” Loneliness was even declared a national epidemic by the former U.S. Surgeon General Vivek Murthy in 2023.

Paradoxically, research suggests that social media may be both a cause and a cure. While technology dependency can lead to social isolation, social media-based interventions can also counter the effects of loneliness, helping people connect and find a sense of identity.

...and unprecedented spending power.

As for shopping, Gen Z has always made purchases on the internet, whether on websites and apps or inside collaborative video games, such as Roblox and Fortnite. Unlike older generations, they don’t remember a time before electronic payments and instant digital purchases. And their combined economic power is about to reshape the global retail economy. According to recent studies, “Gen Z is on track to become the largest and most powerful consumer generation in history… comprising 32% of the global population and 40% of global consumers.” By 2030, their spending power is projected to hit $12 trillion.

For Gen Z, live shopping is more than just simple entertainment or e-commerce. It’s a space that promises the connection, community, and interaction that they long for in real life—as well as a chance to flex their formidable economic muscle. But, as new research from Velocity Ave demonstrates, Gen Z’s relationship to live shopping is complex and sometimes even counterintuitive.

Why? Here’s what our research says:

RESEARCH INSIGHTS

Retail Group Therapy: Gen Z Loneliness Meets Live Shopping

Velocity Ave conducted a nation-wide research study¹—surveying close to 500 respondents—to measure the behavioral, emotional, and motivational factors that define the live shopping experience in the U.S. market.

Our research showed key differences between Gen Z live shoppers and other generations, specifically around topics related to community, connection, and mental well-being.

These effects are further magnified when we focus on young Gen Z (ages 18-26). Compared to other generations, young Gen Z is…

1) 20% more likely to attend live shopping events to be part of a community

One focus of our research was the concept of motivation. Given a variety of options—including apps, websites, and brick-and-mortar stores—what motivates users to choose live shopping?

Why Gen Z chooses live shopping.

We uncovered a variety of answers, ranging from economic to emotional. Some shoppers highlighted financial motives, such as “Great price” or “Get good deals.” Others focused on product selection, citing “Discover new things” or “Access to a product you couldn’t get otherwise.”

While price (e.g., “Great price,” “To get good deals”) is a higher motivator overall, young Gen Z shoppers stand out from other respondents in their desire to be “part of a community.” This motivation—alongside “For entertainment” and “Fear of missing out on a product”—is what distinguishes them from non-Gen Z shoppers.

Live Shopping Motivations

Difference in average motivation ratings (1-7 scale) between Gen Z and non-Gen Z shoppers

What exactly is “community” in live shopping?

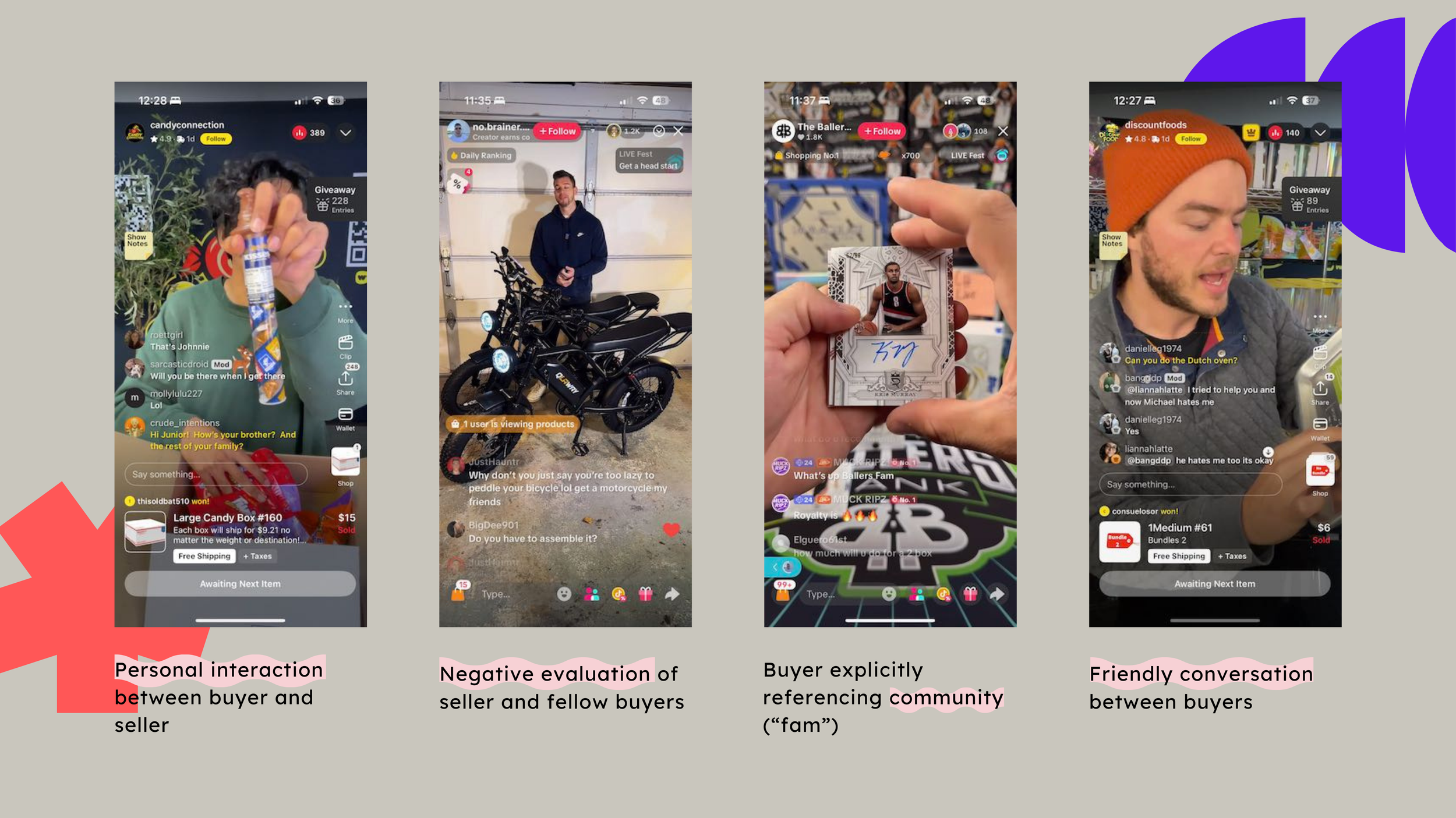

More than any other form of digital commerce, live shopping is inherently social. Interaction between buyers and sellers (and sometimes even between buyers themselves) is key to driving sales and increasing buyers’ confidence in their purchases. Taken as a whole, those interactions—combined with the social ties that they produce—create a sense of community that can be a powerful motivator for Gen Z live shoppers.

During a live shopping session, interaction can take several forms. Most commonly, a seller addresses buyers as a group, speaking directly to the camera to offer product information, personal insights, and calls to action. This creates a first level of community, in which the seller builds an interpersonal connection with the buyers as a collective.

Interaction builds connection

At the same time, virtually all sellers also engage in individualized one-on-one interactions with a smaller subset of buyers. These exchanges are usually initiated by some form of buyer input in the text chat feed. Common examples include:

Greetings - Sellers frequently call out new arrivals by name (e.g., “Hello, greg315!”) when they enter the chat stream. This creates an instant connection and also underscores the dynamic, evolving nature of every live-shopping session.

Responses to questions - As buyers consider purchases, they often use the chat stream to ask questions about topics such as product features, shipping details, payment processing, and flash-sale rules. When sellers reply verbally, they often call out the user’s name in their response (e.g. “TKSAMPLEQUOTE”). At the same time, off-screen members of the sales team can also write responses in the chat stream, providing an additional source of interaction and information.

Thank-you’s - It’s common for sellers to thank individual buyers for completed sales, adding to a sense of community while also offering social proof to other shoppers.

Of course, sellers aren’t the only source of community in live shopping. Buyers also interact with each other in the chat stream by answering questions, supporting shared sentiments, or even just making small talk. In some cases, buyers who frequent similar sales—whether because of the seller, product category, or platform—can become acquainted and form bonds that turn the anonymous crowd of a chat stream into something more like a group text.

Live Shopping Interactions

Why is Gen Z seeking community in live shopping spaces?

“When the pandemic hit, I got that sense of loneliness and a little bit of depression just not being able to see my friends or family members in person. I really value those physical connections. That’s when I jumped onto all of these online spaces: Facebook groups and live shopping events as well as gaming, so I can get a sense of being part of something greater again… With live-shopping events, I can form community [and] build connections on things that we all love and enjoy.”

In the context of the loneliness epidemic, it makes sense that Gen Z would seek connection and kinship in all kinds of social-media interaction, including commerce. Whether hosted inside social media apps (e.g., TikTok Live) or on dedicated commerce platforms (e.g., Ebay Live), live-shopping sessions offer a chance to co-exist—or even interact—with sellers and other users in a virtual space.

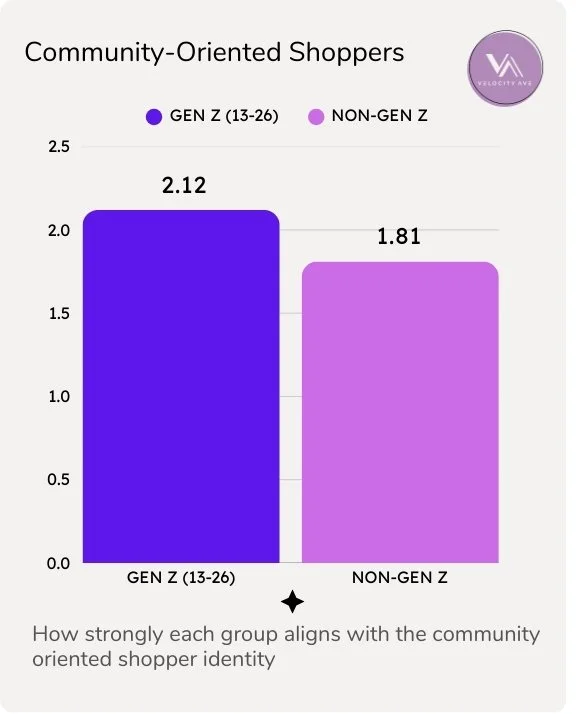

2) 17% stronger in their tendency towards being a “Community-Oriented Shopper”

Buyers don’t necessarily have a single reason for live shopping. Instead, they’re often driven by multiple factors, which can be aggregated and analyzed to reveal patterns of co-occurring motivations.

Social interaction is key for these shoppers, who are motivated to be a part of a community, support sellers they like, and seek out entertainment. The seller-buyer connection is critical for them, and they may follow specific personalities from sale to sale, buying from them preferentially over other sellers in similar categories. Although “seeking entertainment” might not seem to have an obvious connection to community, research has established links between boredom and loneliness—especially in relation to technology. When they look to live shopping for entertainment value, these buyers may also be addressing their own sense of isolation and their desire for connection.

Compared to older age groups, young Gen Z live shoppers show a 17% stronger tendency towards a community-oriented shopping profile, driven strongly by their desire to be a part of a community. But that desire is multidimensional, with interrelated connections to supporting preferred sellers (with whom they might have social or parasocial relationships) and searching for entertainment in live-shopping spaces.

OTHER PROFILES

Deal Seekers - Price is priority number one for these shoppers, who want good deals, great prices, and access to products they couldn’t find elsewhere. Flash sales and time-limited deals, both common features of live shopping sessions, may play to their desire to feel like their money goes further in live shopping than anywhere else online.

Novel Product Explorers - For these buyers, live shopping is a venue for finding products that don’t show up often in traditional retail platforms. Above all, they’re looking for rare items that they couldn’t get otherwise. Unsurprisingly, they’re also more likely to be afraid of missing out on the chance to buy these uncommon goods.

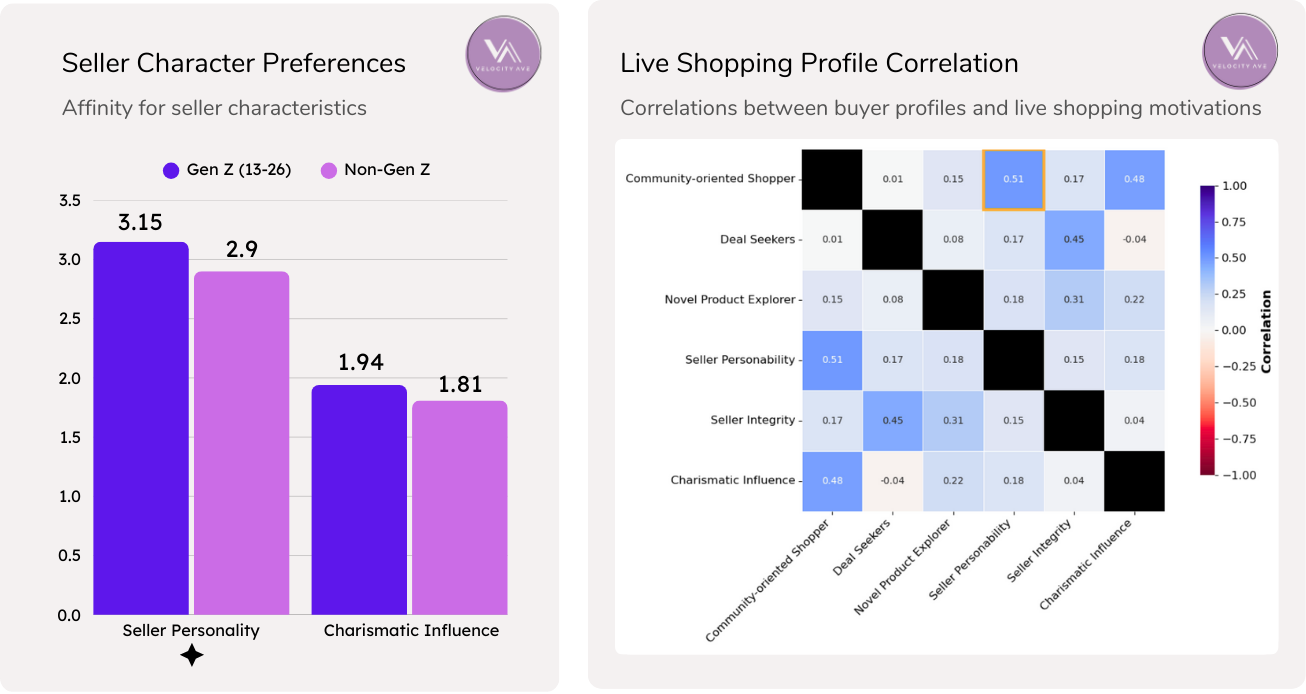

3) Drawn to Sellers Who Are Personable (9% More), and Charismatic (7% More)

All age groups ranked “Integrity” highly as a quality they seek in sellers. But Gen Z shows a distinct preference for personability and charismatic influence, two qualities that hinge on relationships and positive interactions. This is in line with prior research that shows how interactions between buyers and livestream sellers can create psychological proximity to products, which makes a purchase more likely.

Within live shopping spaces, personability can show up in a variety of ways, including frequency and style of interaction. Sellers who engage in more direct interaction with buyers—including personalized call-outs—may be viewed as more personable than those who focus on generalized sales pitches. At the same time, the subjective authenticity of those interactions—for example, whether or not they’re perceived as “genuine” by buyers—may also play a role in creating a favorable impression.

Our data also show a relatively strong correlation between buyers who fit the profile of “Community-Oriented Shopper” and those who are motivated by “Seller Personality.”

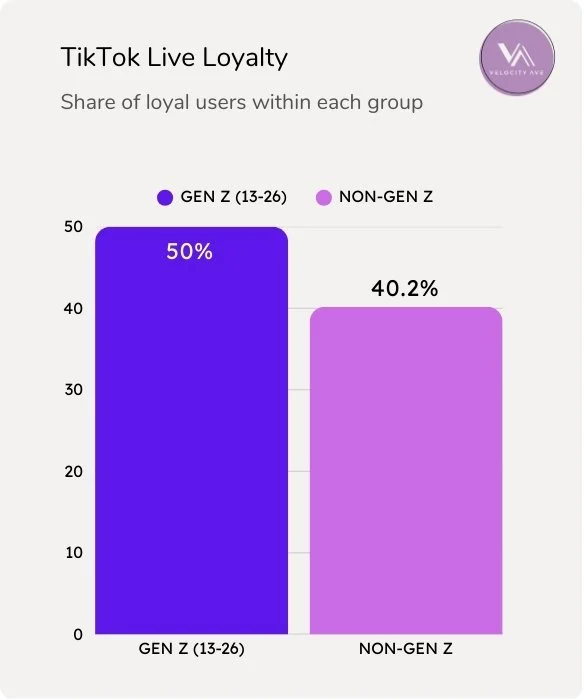

4) 10% More Likely to Prefer TikTok Live

Compared to older groups, Gen Z is slightly less likely to be devoted to a single live-shopping platform. But when they do show loyalty to one, it’s usually to TikTok Live—which captured 50.2% of loyal Gen Z live-shoppers and only 40.2% of non Gen Z. That’s hardly unexpected, given the fact that 78% of Gen Z Americans use TikTok. But there might be more to this brand loyalty than mere convenience.

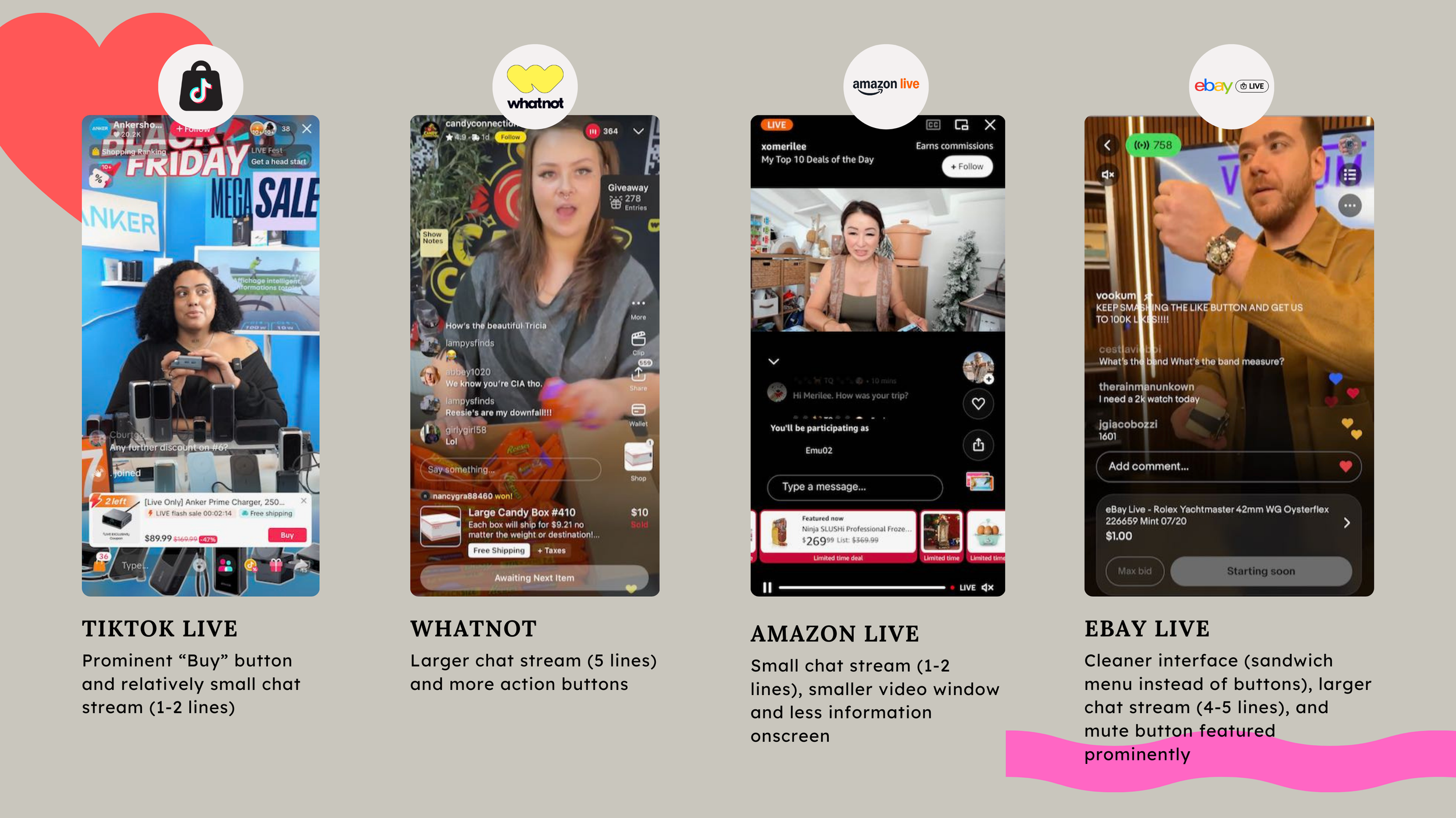

TikTok is currently the only social media app with a robust livestream shopping experience. Unlike Whatnot or Amazon Live, which are purely retail platforms, TikTok gives Gen Z connection and community first, with Live Shopping as an added feature. This could give TikTok an advantage in building loyalty within its Gen Z clientele, who are more likely than other age groups to use live shopping for community and connection.

Platform Comparison

5) 14% More Likely to Visit In-Person Stores

Despite—or perhaps, because of—their reputation as “digital natives,” Gen Z shoppers prize brick-and-mortar stores more than people in older generations do. This may seem counterintuitive for a group that grew up with online shopping, but it falls neatly in line with Gen Z’s larger search for community and connection.

Physical stores are communal third spaces where shoppers might interact—passively or actively—with salespeople and/or other shoppers. But brick-and-mortar stores aren’t easily accessible in every part of the country, and the internet offers a seemingly infinite breadth of products that no physical store can match. With its emphasis on live experience and personal interaction, live shopping might be Gen Z’s best digital proxy for in-store shopping.

But There’s a Catch: For Gen Z, Community Can Be a Double-Edged Sword.

While they seek out community in livestreams, Gen Z shoppers also have a complex relationship with shared online spaces. The presence of other shoppers isn’t necessarily a benefit. In fact, it can even open the door for unpleasant feelings or experiences.

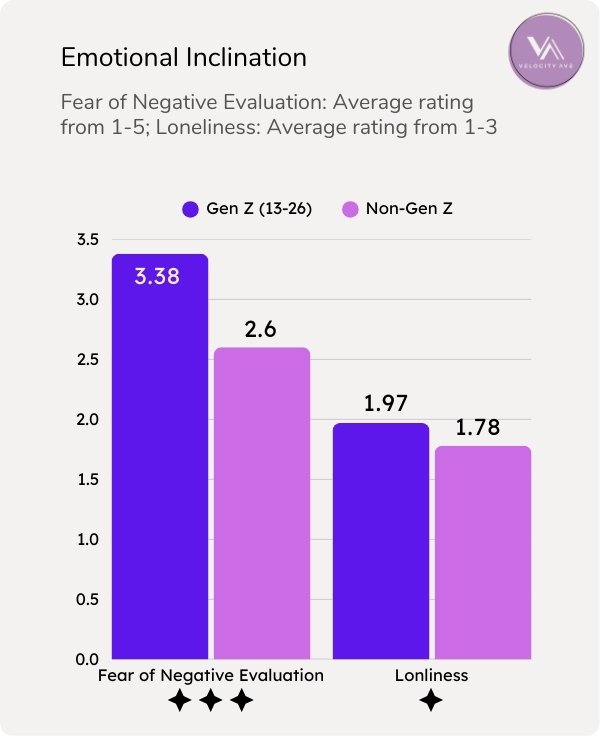

According to research, social isolation—like the loneliness experienced by Gen Z–can result in a loss of self-esteem and self-confidence. Which may help explain why Gen Z shoppers have heightened fear of negative evaluation and are susceptible to feeling “alone in a crowd” in online spaces. Compared to older groups, young Gen Z are…

6) 30% more likely to worry about how they’re perceived by others

As digital natives, Gen Z grew up in a world where social-media reactions— positive and negative—were ubiquitous. (Even “likes,” in insufficient quantities, can feel like implicit criticism.) Their well-documented fear of “cringe” is rooted in humor but also reflects a very real fear of online embarrassment.

“While I was getting into live shopping, I wasn’t interacting at all because I was like, this is new to me. It’s a new environment. It’s hard to mesh yourself. Are the people gonna be rude? Are they gonna like me?”

Compared to older generations, young Gen Z has much higher anxiety around the judgement of their peers, even in virtual spaces. This is measured in our research as a “Fear of Negative Evaluation,” which could take the form of harmful chat stream interactions (e.g., critical statements from other shoppers) or even potentially negative engagement with the seller. While those interactions seem to be relatively rare in live-shopping streams, the threat remains real and present for some Gen Z shoppers.

Other viewers can actually be a negative for live shoppers.

According to a 2024 study, the presence of a live-shopping seller has a positive overall impact on “consumers’ experiences, sense of loneliness, and purchase intention.” However, the same isn’t true for the presence of other viewers. Paradoxically, other viewers can actually intensify shoppers’ loneliness—a phenomenon the study’s authors refer to as “feeling alone in a crowd.”

For live-shopping platforms, the challenge is clear:

How can you create a space that offers community without crowds and interaction without negative evaluation?

Informed by our research, Velocity Ave has created a set of recommendations to do just that:

RECOMMENDATIONS

Optimizing Live Shopping for Gen Z

“Another thing they could build is some in-app community even when they’re not streaming. For example, even when a Twitch streamer is inactive, they have other avenues where their viewers can communicate. That gives you a place to talk outside of the stream itself. And I think when you talk more outside of the stream, it also makes communication easier when there’s a stream going on.”

Stakeholder Insights

Platforms: Partner with the right Sellers

Choose charismatic, personable sellers who focus on positive interaction and cultivate a sense of community.

Sellers: Create the right connections with Gen Z shoppers

Focus on community, not just deals. Be personal, not general.

Product Teams: Design the right features to bring platforms, sellers, and shoppers together

Optimize danmaku (visible livestream comments/reactions) for connection, not clutter—and especially not criticism.

Researchers: Study the line between a beneficial community and a threatening crowd.

Understand why Gen Z shoppers are drawn to social spaces that intimidate them.

WHERE DO WE GO FROM HERE?

Live shopping is growing quickly in the U.S., which means competition between platforms will only get more intense. The winners will be defined by their ability to connect sellers and buyers in ways that meet their unique wants and needs. For Gen Z shoppers, that means speaking to a desire for community without creating spaces that feel crowded or threatening. Further research can investigate the drivers and casual connections that shape Gen Z’s behavior, providing even more insights to help live-shopping platforms sharpen their appeal for the next generation of users.

At Velocity Ave, we believe in designing with emotional insight — and in meeting people where they are to help them get where they want to go. Sometimes that path isn’t linear or driven by traditional metrics of success. But that’s how you build trust, connection, and products that people love.

Let’s work together. Grab some time to chat or send us a quick note.

¹METHODS AND ANALYSIS Bar-graph values represent within-group means. Mean comparisons were conducted using Welch’s t-tests and evaluated against a 10,000-iteration permuted null distribution. Although some figures report only a subset of contrasts, FDR corrections were applied across the full set of items within each question. Profiles were derived using exploratory factor analysis, with mean factor scores zero-aligned and positively aligned (i.e., multiplied by -1) when the underlying dimension extended in the negative direction for interpretability. Statistical significance is denoted as p < 0.05 (*), p < 0.01 (**), and p < 0.001 (***), where more stars indicate stronger statistical evidence.